Startup Business Model and Pricing

A deep dive into the most successful startup business models and pricing strategies—what works, why it works, and how to apply it. Learn from billion-dollar companies and top YC startups to craft a scalable, defensible, and profitable startup.

What will be covered

- The 9 Business models of nearly $B company

- Business model lessons from the YC top 100 companies

- Startup pricing insights

9 Business Models that Build Billion-dollar Companies

- SaaS (cloud-based subscription software)

- Transactional (facilitate transactions & take a cut (usually fintech company))

- Marketplace (facilitate transactions with buyers & sellers)

- Hard-tech (lots of technical risk & long time horizons)

- Usage-based (pay-as-you-go based on consumption)

- Enterprise (sell large contracts to huge companies)

- Advertising (sell ads to monetize free users)

- E-commerce (sell products online)

- Bio (science-based tech companies)

- Business model Guide: Business Model Guide by YC

- Watch it separately from this module, the video will cover:

- The metrics that matter most

- Key takeaways for each model

- Other similar companies you can learn from

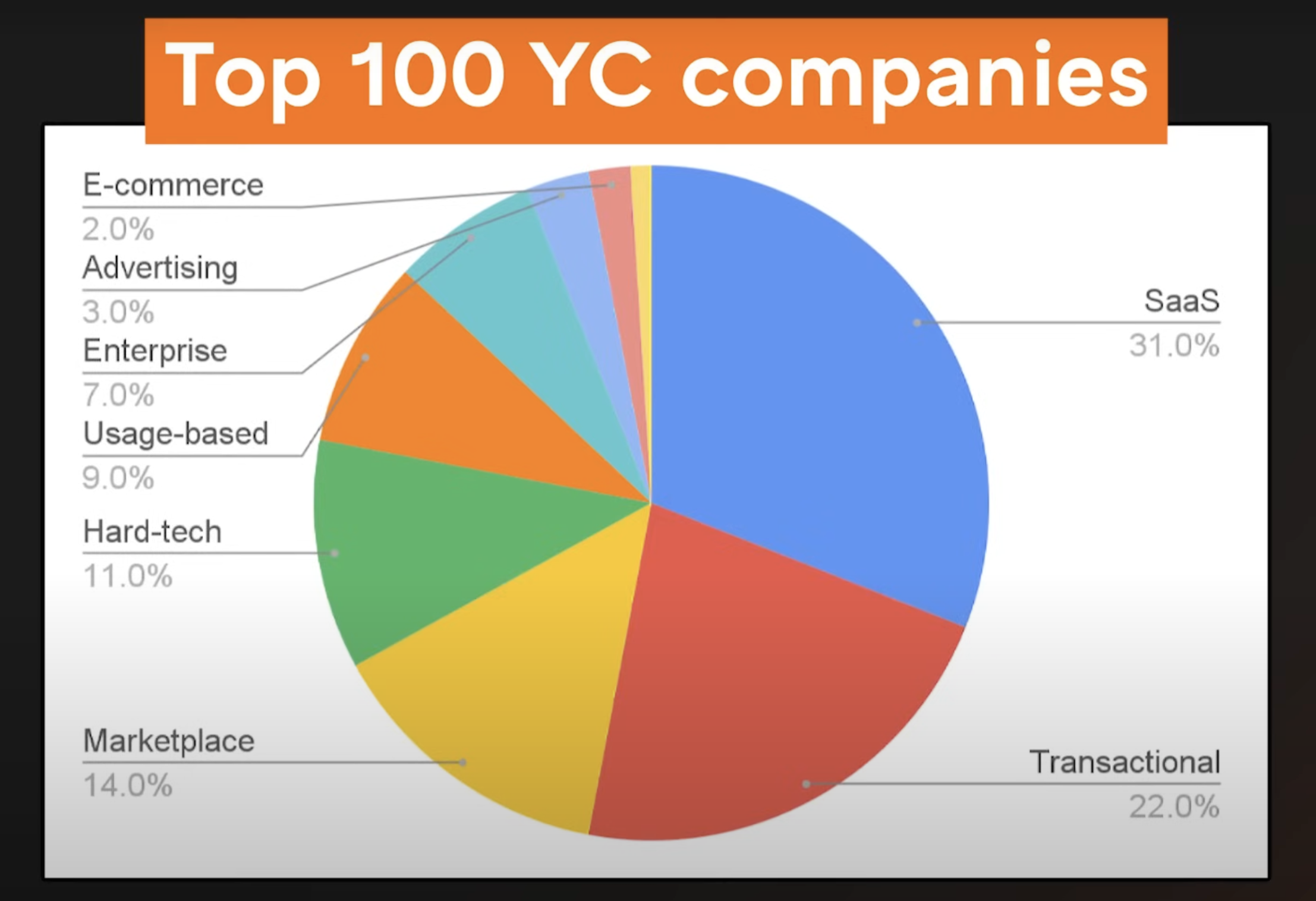

Business model lessons from the top 100 YC Companies

- Top 100 YC Companies: Company List

- Power law effect: the biggest winners far far outperform all other businesses by order of magnitude

- This is true for 100 top YC companies

- 50 % of overall value of the top 100 actually comes from just the top 10

- 5 out of 10 are marketplaces

- Marketplaces are the most likely to build winner-take-all companies

- Marketplaces takeaways from YC:

- 14% top 100 are marketplaces, but they create 30% of the overall value

- They are tough to get off the ground and have chicken & egg problem

- They get massive network effects when they work

- 3 of the top 10 are transactional

- Transactional takeaways from YC:

- Transactional businesses outperform because they’re in the flow of funds (platform where money flow through / easy to get cut)

- 22% of the top 100 are transactional, and they create 29% of the overall value

- Get as close to transaction as possible

- 31% of the top 100 are SaaS companies

- SaaS takeaways from YC:

- The recurring revenue makes them great business

- Could predict their reveneu which later can be compound their growth

- Very few advertising business become big winners (eg: google, twitter, facebook) (only 3% of the top 100 companies are advertising)

- Advertising takeaways from YC:

- They need organic virality to win. When that happens, they get strong network effects.

- Don’t use ads business model unless you expect to be a top 10 site on the internet

Overall Lesson

- What’s not in the top 100

- Services/consulting business

- Non-recurring revenue, scale with people, low margins

- Affiliate businesses

- Too far away from the transactions (multiple things could happened before you get paid)

- Hardware businesses

- Require lots of capital, have low margins

- Business build on other platforms

- Too much platform risk

- Services/consulting business

- Recurring revenue consistently creates winners

- Highly predictable

- Higher LTVs (life time value)

- Lower CACs (customer acquisition cost) / no need to reacquiring over and over

- Recurring revenue only work when you have strong retention

- You need to keep delivering value over and over again otherwise your customer will churn and stop paying

- Example:

- 95% month retention = 54% annual retention

- 5 of 100 will churn every month, if we start with 100 customer, end of year we wil only have 54 customers of your original 100.

- Means: lose 46 customer in a year and need to get 46 new customers just to break even with where you started

- 90% month retention = 28% annual retention

- Biggest winners are built with moats

- Network effects

- Lock-in/high switching costs (eg: transactional like stripe)

- Technical innovation

- Boom (supersonic) or cruise (self-driving)

- Very difficult to compete since it might take years to develop just to catch up

- Higher margins/better unit economics

- Organic distribution (get user for free eg: WOM)

- The Best businesses

- Generate recurring revenue

- Have high retention

- Build defensible moats

- Are close to the transaction

- Scale with software, not people

- Are proven, and familiar to customers

5 Pricing Insight from top YC Companies

- Pricing can teach you

- Who wants your product

- How much they want it

- How much value your product provides

- Which channels you can use to acquire customers

- You should charge, it teaches you:

- Are your users wiling to pay?

- Which users are most willing to pay?

- How much are they willing to pay?

- eg: stripe charge 5% per transaction instead of average market of 3% to know does their developer API and 1 click sign up really valuable or not

- They want to test and proof that they have build enough value to their product

- Don’t overthink it (pricing)

- Find the right “order of magnitude” for your pricing

- if we charge 10$ and customer willing to pay 100$ we should increase the price (we off by order of magnitude)

- If we charge 10$ and customer willing to pay 15$-20$ we are on the right track

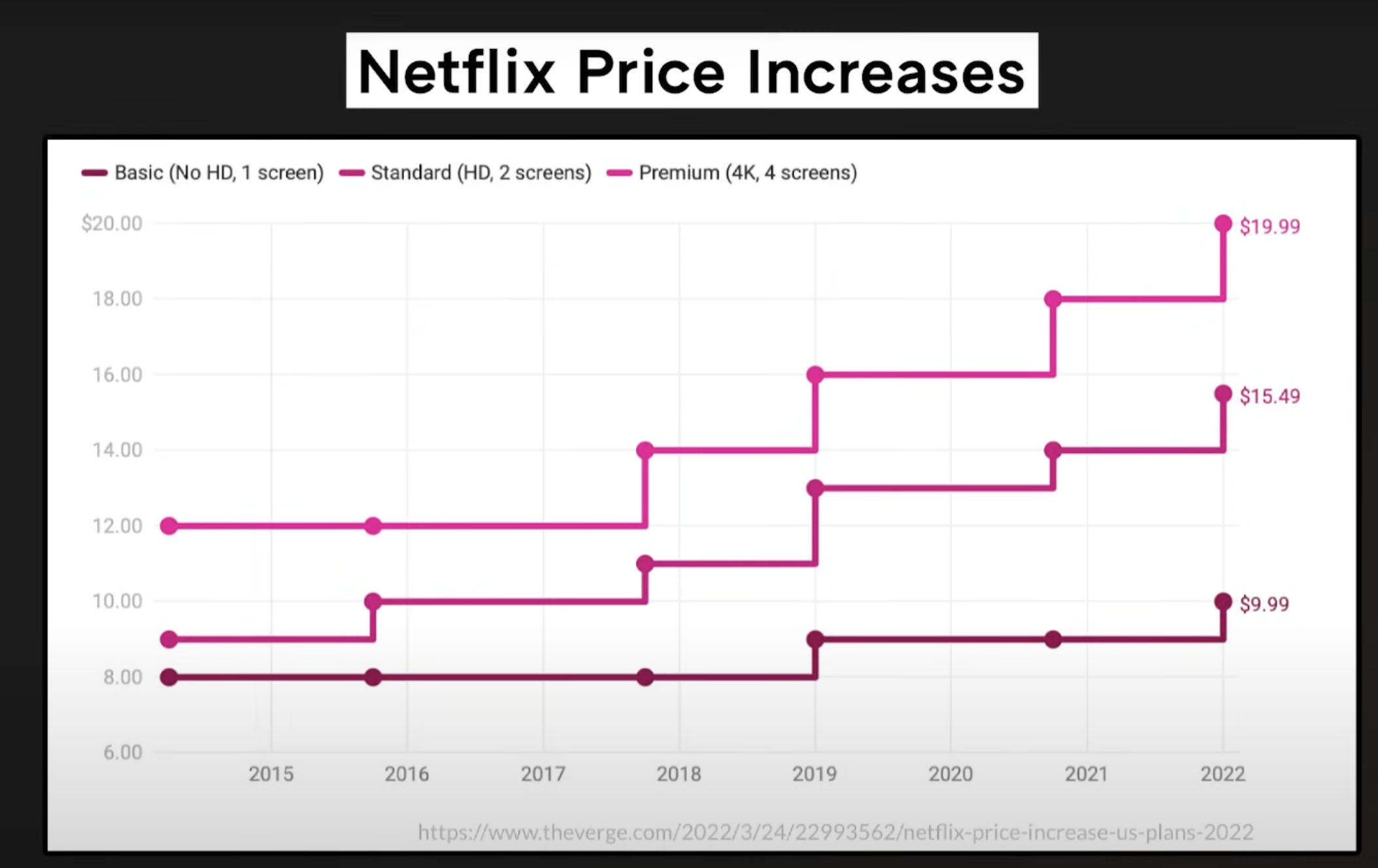

- Pricing isn’t permanent

- Find the right “order of magnitude” for your pricing

- Price on value, not cost

- Founder often start with cost + pricing (NOT RECOMMENDED)

- Price < cost = can’t grow business with negative cashflow

- Price > value = customer won’t buy it

- How to find your value?

- Talk to your users

- Ask them the problem that you solved and get them to articulate value to you

- “What is the problem that you are hoping that our product could solve?”

- Make more money

- Reduce costs

- Move faster

- Avoid Risk

- Keep raising prices until you get pushback

- Ideal price: when customer complain but they still pay

- What if user won’t pay more?

- You need to build more value into your product or

- You need to solve a bigger problem

- Most startups are undercharging

- Pricing implies value

- Lower your price, in exchange for

- Your first user

- A valuable logo

- If you get lock-in (eg: customer data on our platform that could lose if they leave)

- Renew at a higher price

- Pricing isn’t permanent + How to raise your prices + Exclude existing customers + Give advance notice

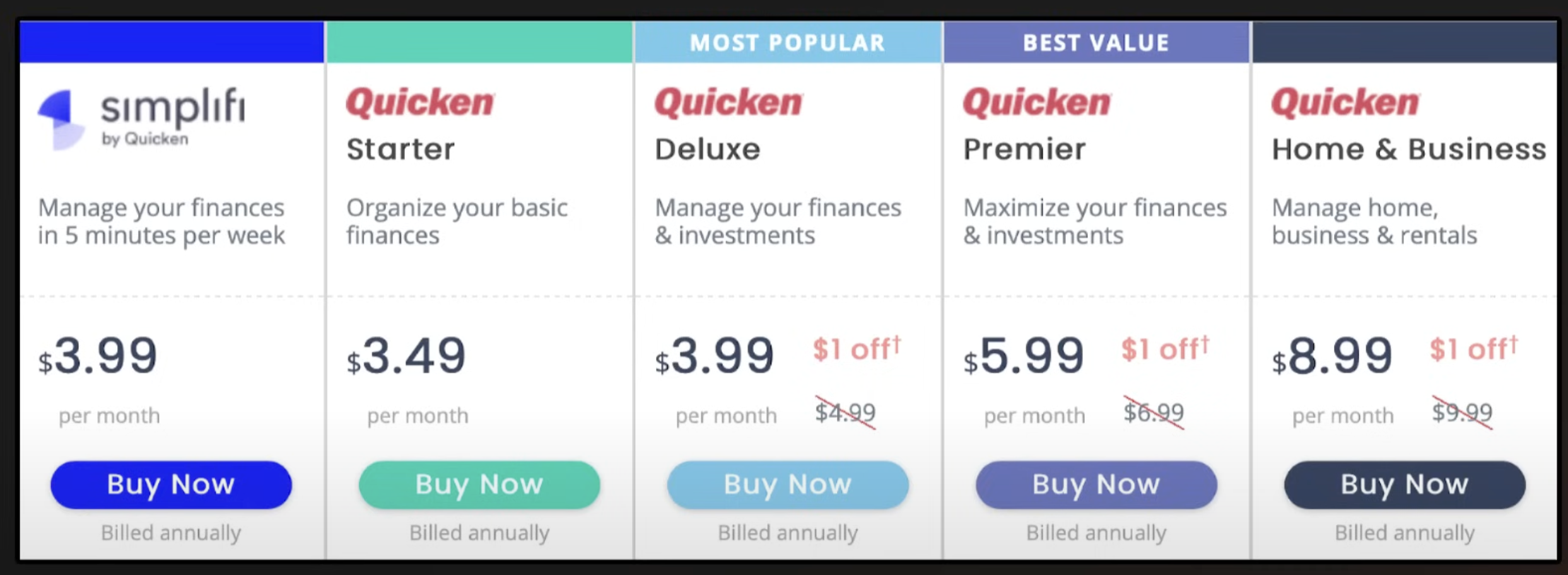

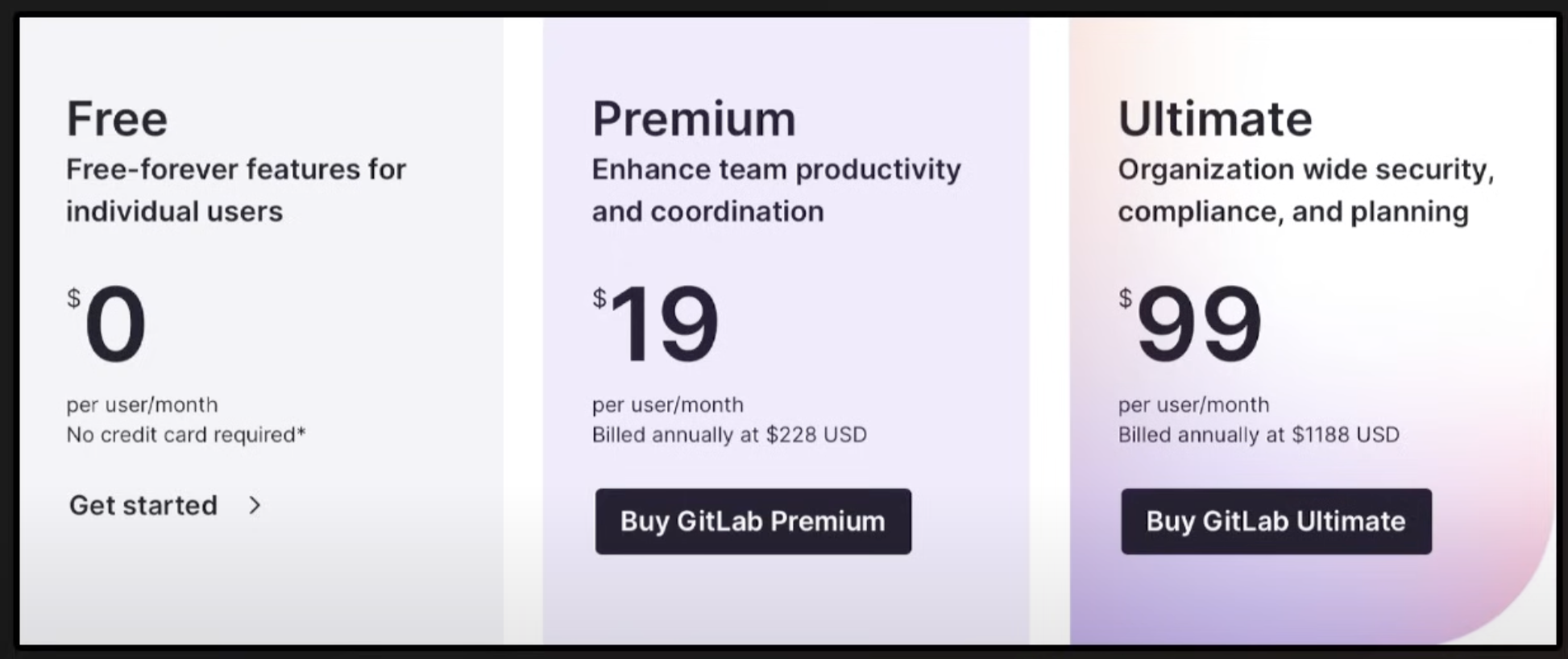

- Keep it simple

- BAD EXAMPLE (So complicated):

- Make sure you don’t want to create friction that prevents customer from sign-up and paying you

- GOOD EXAMPLE (Simplicity):

- BAD EXAMPLE (So complicated):

- Talk to your users

Story of Segment - How to Charge for your Product

- Segment = Help company to capture and use their customer data

- Started couples of engineers that were not used to paying for a product themselves so they though they need to give it for free

- Create and giving away the product for free

- Start charging $120 / year then customer told them to charge more since they scared of losing customer data with them

- Hired a sales advisor and he advised to charge $120.000 / year

- Customer asked for $12.000 but end-up agreeing on $18.000 / year as their price

- They used this philosophy to continue growing to 6 figures and ultimately got acquired by twillio for $3B

Pricing Insights

- You should charge!

- Price on value, not cost

- Most startups are undercharging

- Pricing isn’t permanent

- Keep it simple

Notes

[1] Much of the business model breakdown is inspired by Y Combinator’s Business Model Guide and talks from YC Partners, especially those given during Startup School.

[2] The observation that marketplaces and transactional businesses disproportionately create value comes from YC’s internal analysis of their Top 100 companies, demonstrating the power of being close to the flow of money and capturing network effects.

[3] The insight on retention math (e.g., 90% monthly retention = 28% yearly) is a core YC concept to emphasize how even small churn adds up—and why retention is critical for recurring revenue models.

[4] “Price on value, not cost” and other pricing strategies are drawn from years of YC startup experience and founder mistakes, including stories from Stripe, Segment, and others who learned to charge more by understanding the real value their product delivered.

[5] The Segment pricing story is based on real founder anecdotes shared in YC office hours and public blog posts—illustrating how startup founders often begin with underconfidence in pricing and learn to adapt by listening to customers.